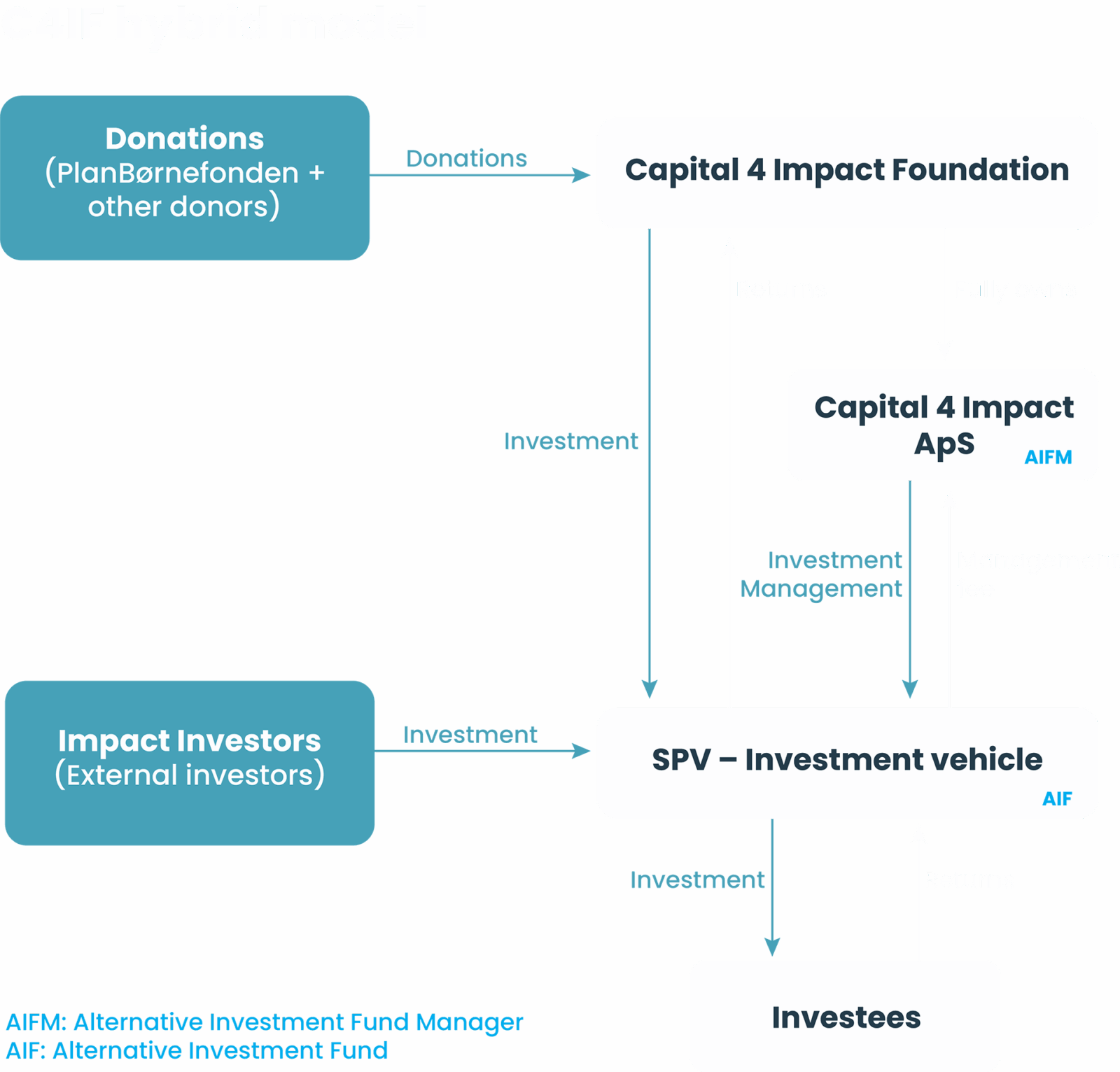

Capital 4 Impact Foundation (C4IF) was established by PlanBørnefonden in 2024 as an independent commercial foundation and C4IF has established a fully owned Alternative Investment Fund Manager, Capital 4 Impact ApS (C4I).

C4I is registered with the Danish Financial Supervisory Authority as a manager of alternative investment funds (AIFM) with a license to manage funds for up to Euro 100 million. We can receive investments from professional and semi-professional investors who wish to invest a minimum of EUR 100,000.

C4I will develop, fundraise for and manage funds that are intended to deliver market conform risk adjusted financial returns and measurable social and environmental impact in developing countries, notably in Africa and Middle East.

The individual funds will be tailored to suit the specific impact target, and the financial instrument applied to the individual fund can vary over equity, loans, mezzanine, social impact bonds etc.

Our strong strategic partnership with PlanBørnefonden(PB)/Plan International (PI) grant us access to a strong investment pipeline and ensure solid due diligence of opportunities, and our unique hybrid structure allow us to blend philanthropic donations with commercial capital which enable us to offer private investors access to high impact investments with market conform risk adjusted financial returns.

Our funds are classified as Article 9 Funds under EU’s SFDR regulation.

Our team and our partnership with PB/PI

Our Investment Team brings significant experience from social impact investments, hereunder impact measurement. Our Board brings solid experience and competences within investments, impact and legal, and our Investment Committee work closely with the Investment Team on pipeline development and investment management.

The AIFM regulation ensures proper management and oversight of alternative investment funds, including requirements for risk management, transparency, investor protection, and ongoing reporting to the Danish Financial Supervisory Authority.

C4I builds on PB’s/PI’s long proven strong “feet on the ground” track-record and expertise in impact measurement, setting us apart from traditional asset managers. Our direct access to investees, strong local presence, and adherence to world-class standards enable rigorous, high-quality impact measurement. This ensures transparent reporting across social, environmental, and financial outcomes, providing investors with confidence that every dollar delivers measurable, lasting impact on the ground.

De-risking through Plan International: C4IF is strategically leveraging Plan International’s deep-rooted knowledge of local communities to mitigate risk for investors, positioning itself uniquely at the intersection of profitability and impact. By working in tandem with Plan International, C4IF gains access to a pipeline of high-potential projects that are both financially viable and socially transformative. Plan International’s extensive experience and trusted presence on the ground act as a powerful de-risking factor, providing critical insights into community needs, stakeholder dynamics, and implementation realities.

Value proposition to Investors

We offer impact focused investors access to high impact investments in developing countries with expected market conform risk adjusted returns in blended finance structures with risk mitigation through our strong partnership with PB/PI.